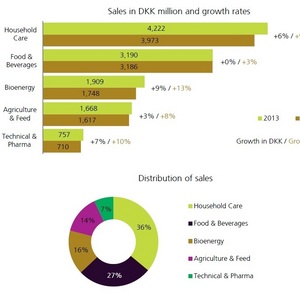

Bioenergy sales contribute to Novozymes' 2013 growth

Novozymes

January 21, 2014

BY Erin Voegele

Advertisement

Advertisement

Related Stories

Origin Materials on April 3 announced the successful conversion of wood residue feedstock, such as wood chips, shavings and sawdust, into sustainable intermediates at Origin 1, its first commercial-scale plant.

Neste and New Jersey Natural Gas have announced NJNG will fuel its medium-duty trucks and associated equipment with Neste MY Renewable Diesel to help reduce greenhouse gas (GHG) emissions.

Meridian Energy Group Inc., the developer of a proposed greenfield oil refinery in Belfield, North Dakota, on April 16 announced that the facility will have the ability to co-process up to 4,000 barrels per day vegetable oil.

The U.S. Department of Energy is advancing ambitious decarbonization targets for the maritime transportation sector, both domestically and internationally at Singapore Maritime Week by teaming with over 15 government and industry partners.

The International Biomass Conference & Expo was held in Richmond, Virginia, in early March.