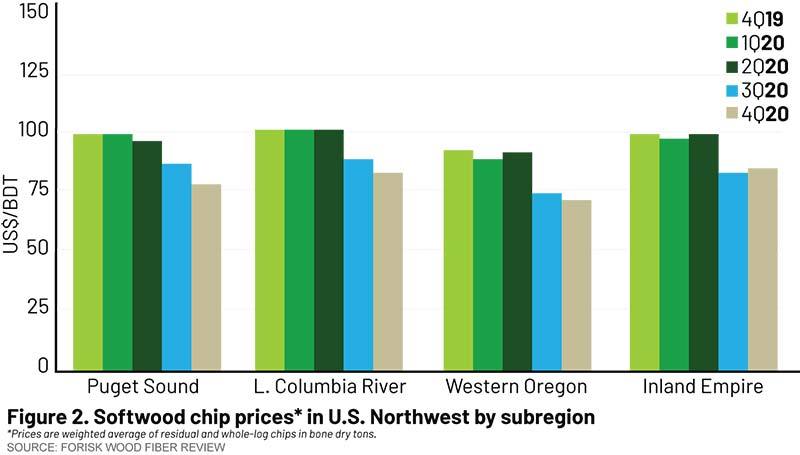

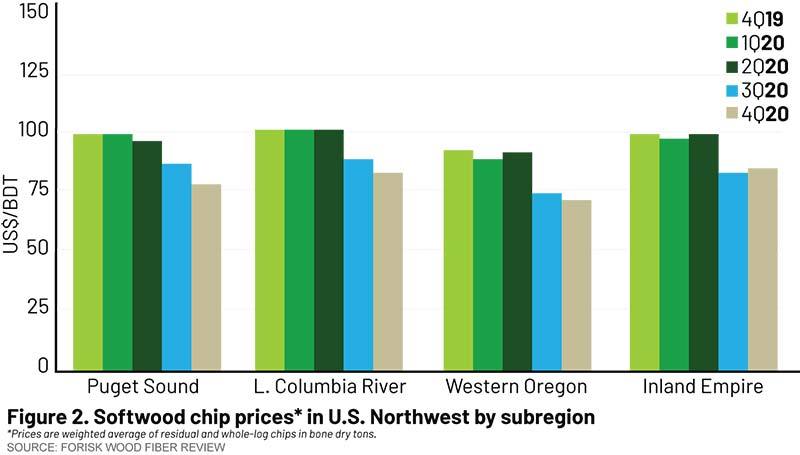

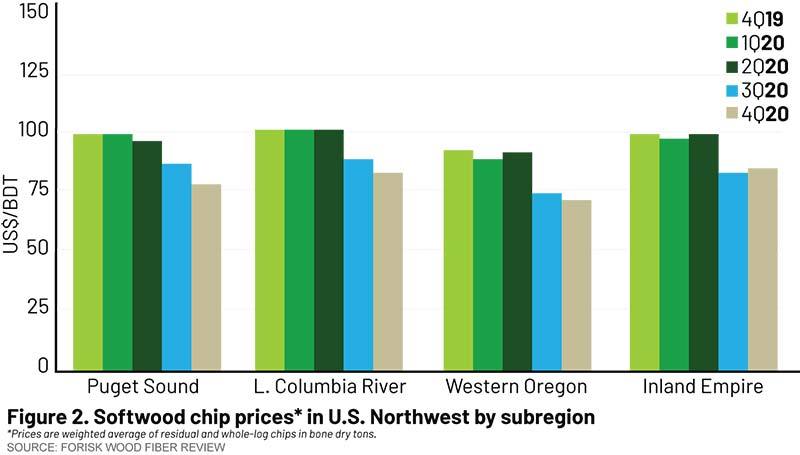

Forisk Wood Fiber Review: U.S. Northwest Prices in Q4 2020

February 4, 2021

BY Andrew Copley

Advertisement

Advertisement

Related Stories

A bill introduced by Sen. Cory Booker, D-N.J., would require the U.S. EPA to alter the way it assesses lifecycle GHG emissions from forest biomass. ABEA stresses that any accurate assessment must account for the alternative fate of biomass fuels.

Moisture in wood and biomass operations impacts product as well as equipment, energy usage, production efficiency, downtime and more.

A bioenergy with carbon capture and storage (BECCS) project under development in Sweden by Stockholm Energi was awarded planning approval on March 28 by the country’s Land and Environmental Court.

The U.S. DOE has opened a funding opportunity making up to $25 million available to support clean energy technology deployment on Tribal lands. Projects fueled by biomass, biogas, RNG or renewable hydrogen are among those eligible for the funding.

The International Biomass Conference & Expo was held in Richmond, Virginia, in early March.