Energy consulting firm launches new company for wood fiber sales

Aeon Energy Solutions Inc.

October 31, 2016

BY Katie Fletcher

Advertisement

Advertisement

Related Stories

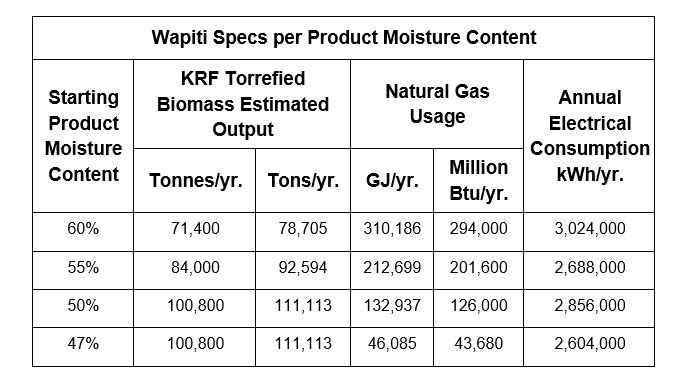

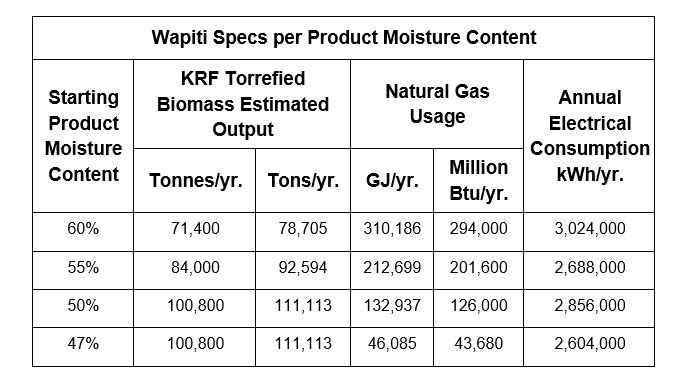

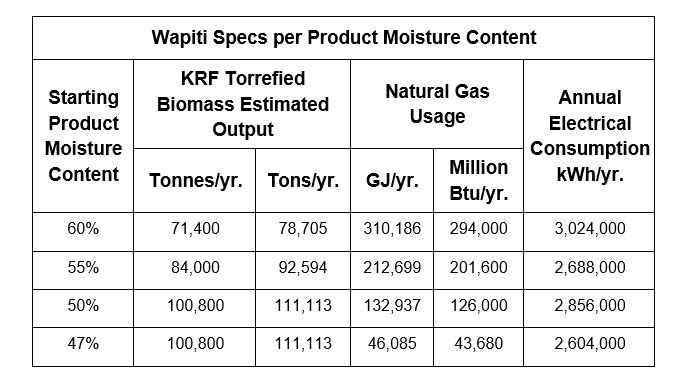

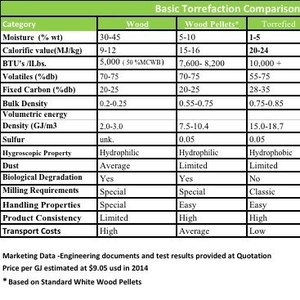

Moisture in wood and biomass operations impacts product as well as equipment, energy usage, production efficiency, downtime and more.

A bioenergy with carbon capture and storage (BECCS) project under development in Sweden by Stockholm Energi was awarded planning approval on March 28 by the country’s Land and Environmental Court.

Waste-to-energy provider Covanta has announced the next milestone in its strategic evolution as a pioneering sustainable waste solutions company with its new identity: Reworld.

The U.S. DOE has opened a funding opportunity making up to $25 million available to support clean energy technology deployment on Tribal lands. Projects fueled by biomass, biogas, RNG or renewable hydrogen are among those eligible for the funding.

The International Biomass Conference & Expo was held in Richmond, Virginia, in early March.