New research addresses biomass supply variation risk

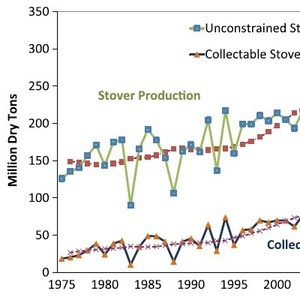

“Effects of corn stover year-to-year supply variability and market structure on biomass utilization and cost�

January 26, 2016

BY Anna Simet

Advertisement

Advertisement

Related Stories

The American Transportation Research Institute on April 23 released a new report that analyzes the benefits of employing renewable diesel (RD) as an alternative to battery electric vehicle (BEV) trucks.

The Transport Project and Coalition for Renewable Natural Gas (RNG Coalition) on April 24 announced that 79%of all on-road fuel used in natural gas vehicles in calendar year 2023 was RNG surpassing the previous year’s record-breaking level.

Vertimass on April 23 announced that the U.S. EPA has approved registration for blending up to 20% of Vertimass green gasoline with conventional gasoline. This new renewable gasoline product, VertiGas20, is made from renewable ethanol.

Origin Materials on April 3 announced the successful conversion of wood residue feedstock, such as wood chips, shavings and sawdust, into sustainable intermediates at Origin 1, its first commercial-scale plant.

Neste and New Jersey Natural Gas have announced NJNG will fuel its medium-duty trucks and associated equipment with Neste MY Renewable Diesel to help reduce greenhouse gas (GHG) emissions.